The 25-Second Trick For Paul B Insurance

The Greatest Guide To Paul B Insurance

Table of ContentsAll about Paul B InsuranceFascination About Paul B InsurancePaul B Insurance - QuestionsWhat Does Paul B Insurance Do?Paul B Insurance Fundamentals ExplainedThe Basic Principles Of Paul B Insurance

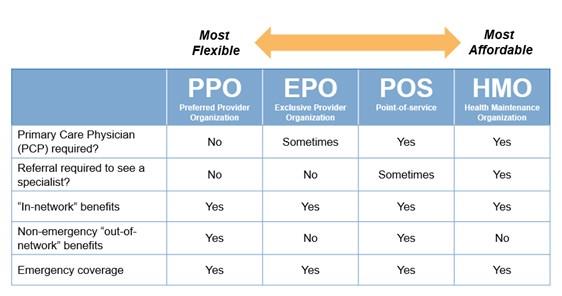

Relevant Subjects One reason insurance coverage issues can be so confounding is that the health care market is constantly transforming and the insurance coverage prepares provided by insurance providers are tough to categorize. In other words, the lines in between HMOs, PPOs, POSs and other kinds of coverage are usually fuzzy. Still, recognizing the makeup of numerous plan kinds will be helpful in reviewing your alternatives.PPOs usually provide a bigger choice of companies than HMOs. Premiums may be comparable to or slightly greater than HMOs, as well as out-of-pocket prices are generally higher and extra complex than those for HMOs. PPOs permit participants to venture out of the supplier network at their discretion and also do not require a recommendation from a medical care medical professional.

Once the deductible amount is gotten to, extra wellness expenses are covered based on the arrangements of the medical insurance policy. A staff member could then be accountable for 10% of the expenses for treatment gotten from a PPO network service provider. Down payments made to an HSA are tax-free to the company and also staff member, and money not invested at the end of the year may be rolled over to pay for future clinical expenditures.

The Ultimate Guide To Paul B Insurance

(Particular constraints might relate to very compensated individuals.) An HRA has to be funded exclusively by a company. There is no restriction on the amount of money an employer can contribute to employee accounts, nevertheless, the accounts may not be moneyed with employee salary deferments under a cafeteria plan. In addition, employers are not allowed to reimburse any part of the equilibrium to workers.

Do you recognize when the most fantastic time of the year is? No, it's not Xmas. We're discussing open enrollment period, child! That's right! The wonderful season when you reach compare health insurance policy plans to see which one is appropriate for you! Okay, you obtained us.

The Paul B Insurance Diaries

When it's time to pick, it's crucial to know what each plan covers, just how much it costs, and also where you can use it? This things can really feel complicated, however it's easier than it seems. We assembled some functional learning steps to aid you feel great about your choices.

Emergency situation care is frequently the exemption to the rule. Pro: Many PPOs have a respectable choice of companies to select from in your location.

Disadvantage: Greater costs make PPOs more expensive than other kinds of strategies like HMOs. A wellness upkeep company is a medical insurance strategy that normally just covers care from physicians that benefit (or contract with) that certain plan.3 Unless there's an emergency, your strategy will certainly not pay for out-of-network treatment.

The Of Paul B Insurance

More like Michael Phelps. It's excellent to recognize that plans in every category provide some kinds of free precautionary care, as well as visit here some offer cost-free or affordable health care solutions before you fulfill your insurance deductible.

Bronze plans have the most affordable regular monthly costs but the greatest out-of-pocket prices. As you function your method up via the anchor Silver, Gold and Platinum classifications, you pay extra in costs, however much less in deductibles and also coinsurance. But as we pointed out in the past, the extra expenses in the Silver group can be minimized if you get the cost-sharing reductions.

Decreases can decrease your out-of-pocket medical care costs a great deal, so obtain with among our Endorsed Local Companies (ELPs) that can aid you figure out what you may be eligible for. The table below shows the portion that the insurer paysand what you payfor covered costs after you meet your deductible in each plan category.

Some Of Paul B Insurance

Other expenses, commonly called "out-of-pocket" expenses, can accumulate rapidly. Things like your insurance deductible, your copay, your coinsurance quantity and your out-of-pocket maximum can have a huge effect on the complete price. Below are some costs to keep close tabs on: Deductible the quantity you pay before your insurer pays anything (other than for free preventative treatment) Copay a collection amount you pay each time for things like doctor visits or other services Coinsurance - the percent of medical care services you are in charge of paying read the full info here after you have actually hit your deductible for the year Out-of-pocket optimum the yearly limitation of what you are in charge of paying on your very own One of the very best methods to conserve cash on medical insurance is to make use of a high-deductible health insurance (HDHP), specifically if you don't anticipate to on a regular basis make use of clinical services.

These work rather much like the other health and wellness insurance coverage programs we described currently, yet practically they're not a type of insurance coverage.

If you're attempting the DIY path and have any remaining questions about health and wellness insurance policy plans, the experts are the ones to ask. And also they'll do greater than just answer your questionsthey'll likewise discover you the finest cost! Or perhaps you would certainly such as a way to incorporate obtaining wonderful healthcare coverage with the chance to help others in a time of requirement.

The Basic Principles Of Paul B Insurance

Our relied on partner Christian Medical care Ministries (CHM) can help you identify your options. CHM helps families share medical care expenses like medical tests, pregnancy, hospitalization as well as surgical procedure. Hundreds of people in all 50 states have used CHM to cover their medical care requires. And also, they're a Ramsey, Relied on companion, so you know they'll cover the medical bills they're meant to as well as honor your protection.